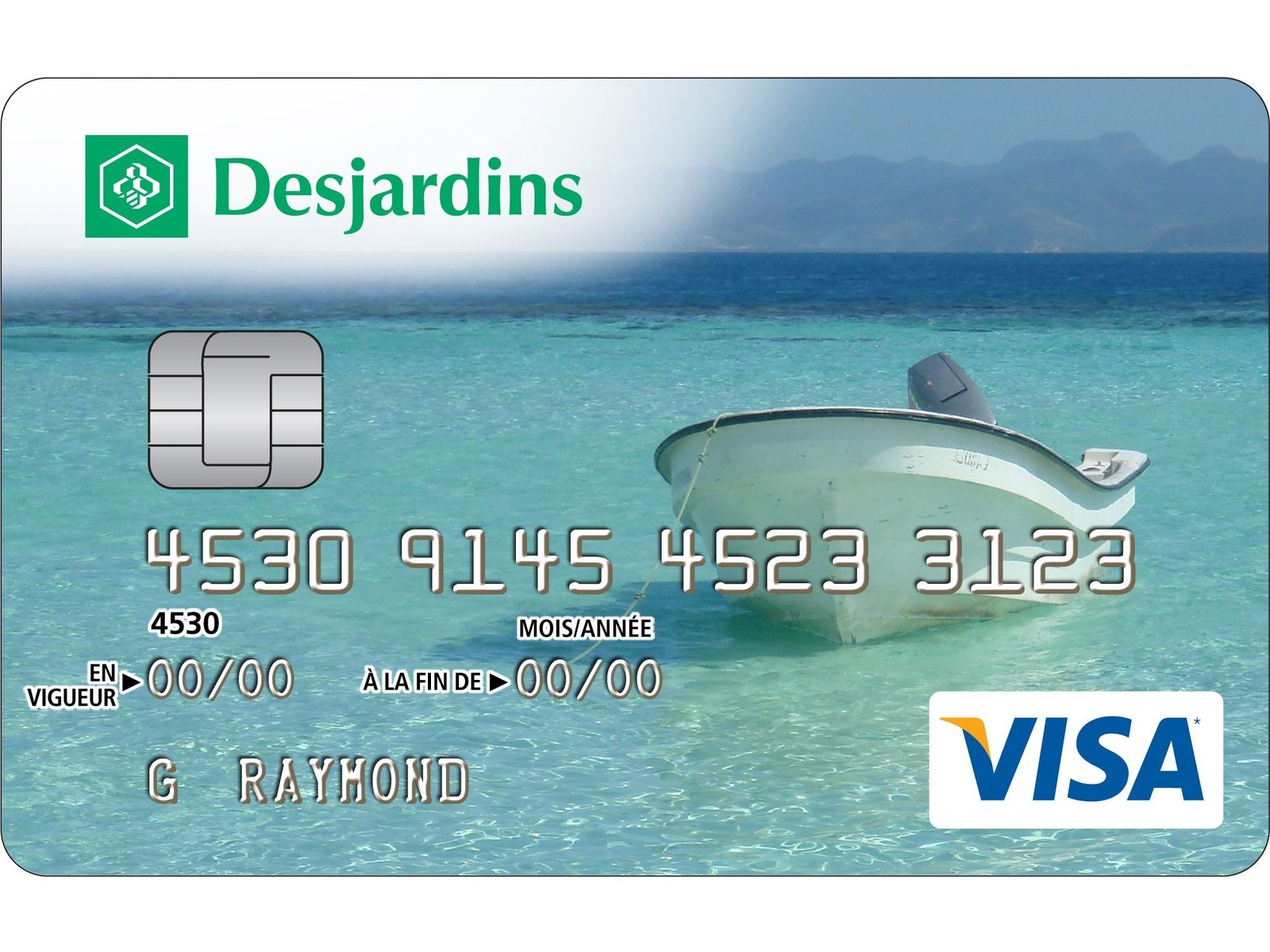

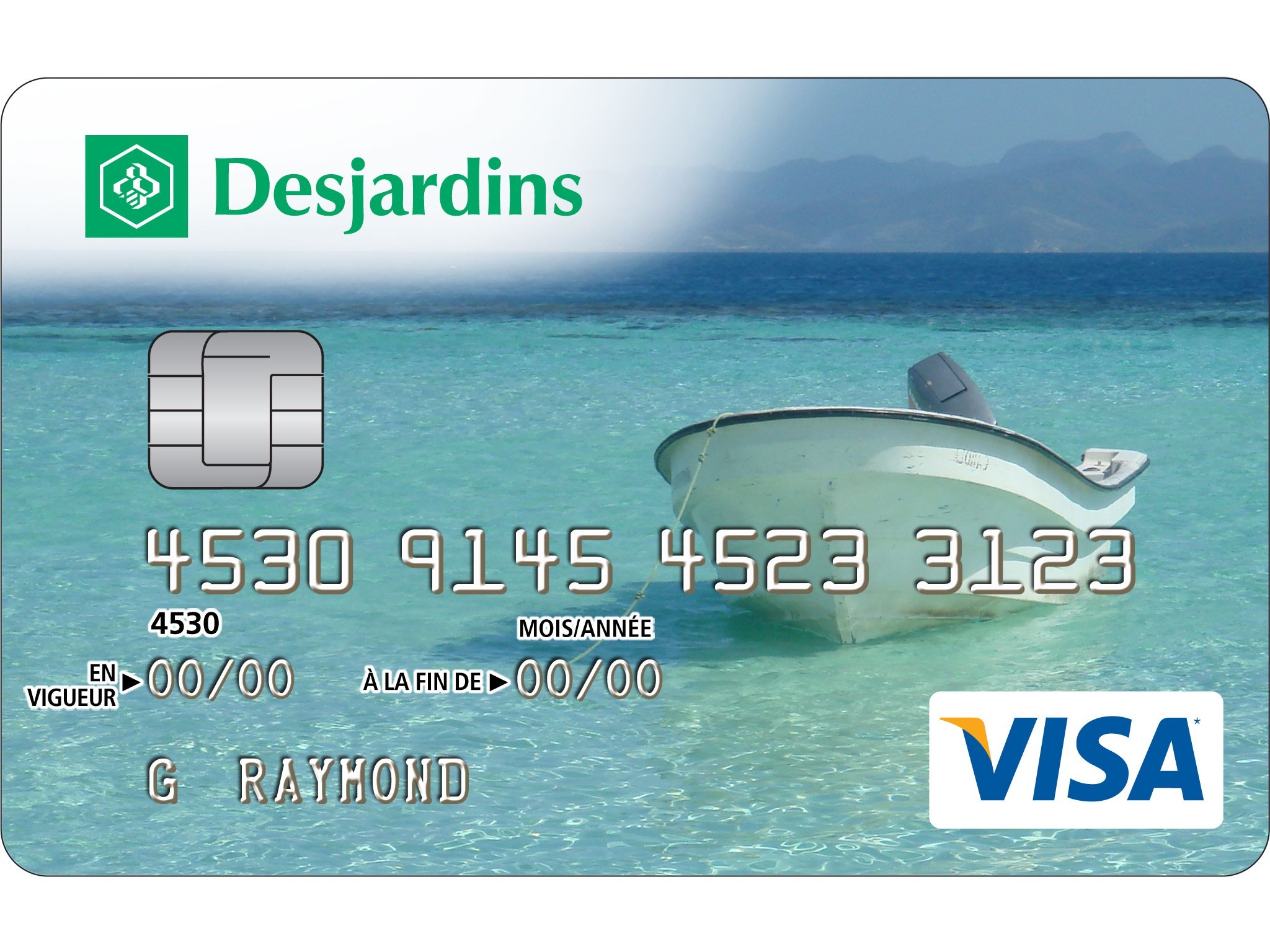

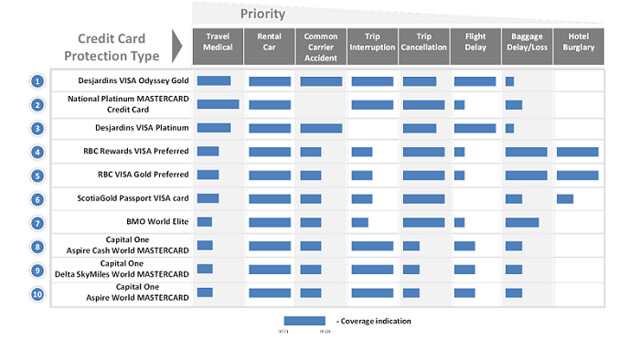

Fig. 1 Top 10 Canadian credit cards for travelers according to InsurEye

Magnifying the fine print

There are several flags we need to raise about the technicalities of credit card travel insurance:

1. Rental car insurance on credit cards only covers collision damages, NOT your liability (you damage someone’s property or health) or your incurred injuries

2. If you have any health issues prior to the trip (e.g. treatment or sometimes even visits to the doctor), they can impact availability of your protection. Check the details of your insurance

3. Nearly all types of credit card insurance are activated only if you pay for the corresponding services with the credit card and keep your bill (e.g. renting a car, booking flight tickets)

4. Many cards have limitations for travellers aged 55+. The insurance protection can be reduced or not available.

Dmitry Mityagin, co-founder of InsurEye says: “We are happy to present this ranking, which should help Canadian consumers not only save their money, but also improve their knowledge about protection available through their credit cards.â€

Remember: When it comes to the insurance, you can't afford mistakes!

InsurEye (www.insureye.com) Inc. is a Canadian company that provides independent, innovative online services to help consumers better understand and manage their insurance. Detailed knowledge about over 160 Canadian credit cards has allowed InsurEye to compile an in-depth card assessment and provide a list of the top credit cards for travel.

InsurEye Credit Card Navigator: https://insureye.com/insurance_toolkit

Facebook: https://www.facebook.com/InsurEye

Twitter: https://twitter.com/InsurEye